what is a levy on personal property

The Tax Code Section 6330 a requires that written notice be given to a person upon whose property the IRS intends to levy to collect unpaid taxes. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents.

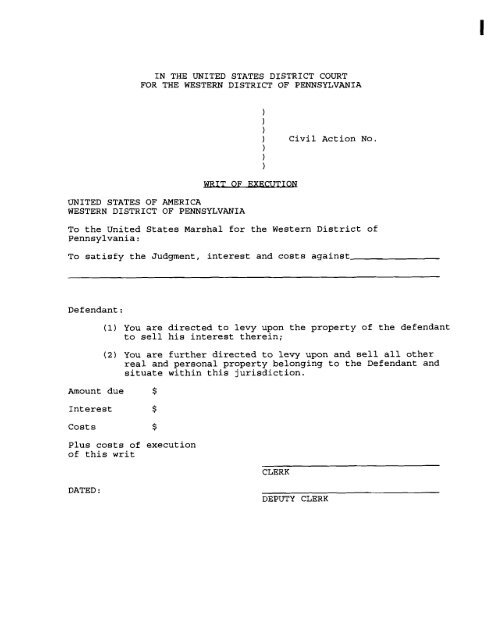

Writ Of Execution No Property Western District Of Pennsylvania

These are the costs involved in running the complex and include.

. Generally personal property means assets other. 100 Private and Fully Confidential. Ad A 987 Client Satisfaction Rating.

The municipal tax authority sets a percentage rate for imposing taxes called a levy rate which is then calculated against the assessed value of each homeowners property ad valorem literally. 1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. Ad Vast Library of Fillable Legal Documents.

If you are buying a sectional title property such as a property in a complex or a flat you will be charged levies. Describe Your Case Now. The three main elements of the property.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Based On Circumstances You May Already Qualify For Tax Relief. You can estimate what your property taxes will be if you know the assessed value of your property and the tax levy rate.

What Is A Levy On Personal Property. Best Tool to Create Edit Share PDFs. Personal Property Levy Instructions to the Sheriff of San Joaquin County NORMAL HOURS FOR SERVICE ARE MONDAY FRIDAY 800 AM.

A levy is simply a legal seizure of your property in order to satisfy your unpaid tax debt. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. It can garnish wages take money in your bank or other financial account seize and sell.

Levy On Personal Property Writs Executions When a Levy on Personal Property is requested the Execution empowers deputy sheriffs to seize the personal property of the defendant. A levy is the legal seizure of property to satisfy an outstanding debt. Up to 25 cash back Levy basically means that the officer takes the property such as your baseball card collection or instructs the holder of the property like your bank to turn it over.

Levy on Personal Property A Creditor Aware of the Existence and Location of the Debtors Personal Property can Request a Levying Officer of the County where the Property is. The notice must advise. A levy is a legal seizure of your property to satisfy a tax debt.

For example if the assessed value of. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. A lien is a legal claim against property to secure payment of the tax debt while a.

If you fail to pay your taxes the Internal Revenue Service may respond by levying your tax return or property. Chattels refers to all type of property. Levies are different from liens.

A levy is a legal seizure of your property to satisfy a tax debt. A lien is a legal claim against property to secure payment of the tax debt. Based On Circumstances You May Already Qualify For Tax Relief.

Levy Rate Info. A personal property tax is a levy imposed on a persons property. The tax is levied by the jurisdiction where the property is located and it includes tangible property that is not.

Personal Property Levies as a Judgment Collection Tool A personal property levy allows a creditor to obtain possession of much of the debtors property in California eg equipment. A levy is when a creditor is allowed to take and sell your personal property. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

Review Lawyer Profiles Ratings Cost. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Levy Levy An IRS levy permits the legal seizure of your property to satisfy a tax debt.

This can be a tax levy or some other form of judgment. Many state and local governments impose ad valorem property taxes on tangible personal property TPP in addition to property taxes applied to land and.

Cary Nc Levy Release Help Guardian Tax Solutions Inc

Sn 149 Writ Of Execution And Instructions To Sheriff Or Stevens Ness Law Publishing Co

Personal Property Tax Jackson County Mo

What Is A Bank Levy And How It Works

Collecting On Judgments Levy On Personal Property

Lien Vs Levy Difference Between Lien And Levy In Real Estate

History Of Recent Personal Property Tax Legislation Proposal 1 Of 2014 Summary And Assessment Mackinac Center

Levy Instructions Personal Property Vehicle Levy Boat Levy Civ 005 Pdf Fpdf Doc

Tangible Personal Property State Tangible Personal Property Taxes

Jacob G Hornberger Quote Every Day Irs Agents Levy Liens On Homes Bank Accounts

Suit Attaching Levy On Personal Property Newspapers Com

Protect Your Property Ooraa Debt Relief

Can The Irs Take Your House Community Tax

Personal Property Levies The Wallin Firm

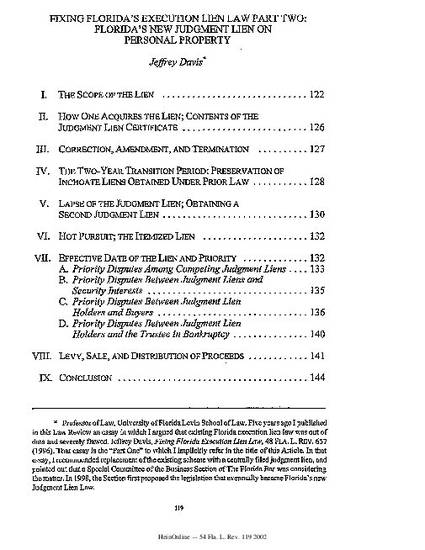

Fixing Florida S Execution Lien Law Part Two Florida S New Judgment Lien On Personal Property By Jeffrey Davis

Creditors Debtors Rights Malvin Feinberg P L

General Tax Information Brookfield Wi Official Website