south carolina inheritance tax waiver form

Probate Court Forms. _____ CASE NUMBER.

Gold Gym Waiver Form Fill Online Printable Fillable Blank Pdffiller

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000.

. South Carolina has no estate tax for decedents dying on or after January 1 2005. For current information please consult your legal counsel or. Notary Public Application PDF Motor Vehicle Forms.

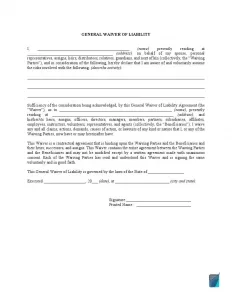

You pay inheritance tax as part of your income taxes in the form of inheritance-based. IN THE MATTER OF. South carolina inheritance tax waiver form Friday 11 March 2022 In the law of inheritance wills and trusts a disclaimer of interest also called a renunciation is an attempt by a person to renounce their legal right to benefit from an inheritance either under a will or through intestacy or through a trustA disclaimer of interest is irrevocable.

Form NameTransmittal Form for W-2s or 1099s Submitted by CD-ROM. Annual Report of Guardian - 534PC. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

However you are only taxed. All Major Categories Covered. Proof of Delivery - 120PC 1-2014 Certification of Completion of Premarital Preparation Course - 153PC.

Form NameSC Withholding Quarterly Tax Return. Estate planning in South Carolina Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs. Individual Income Tax - Forms.

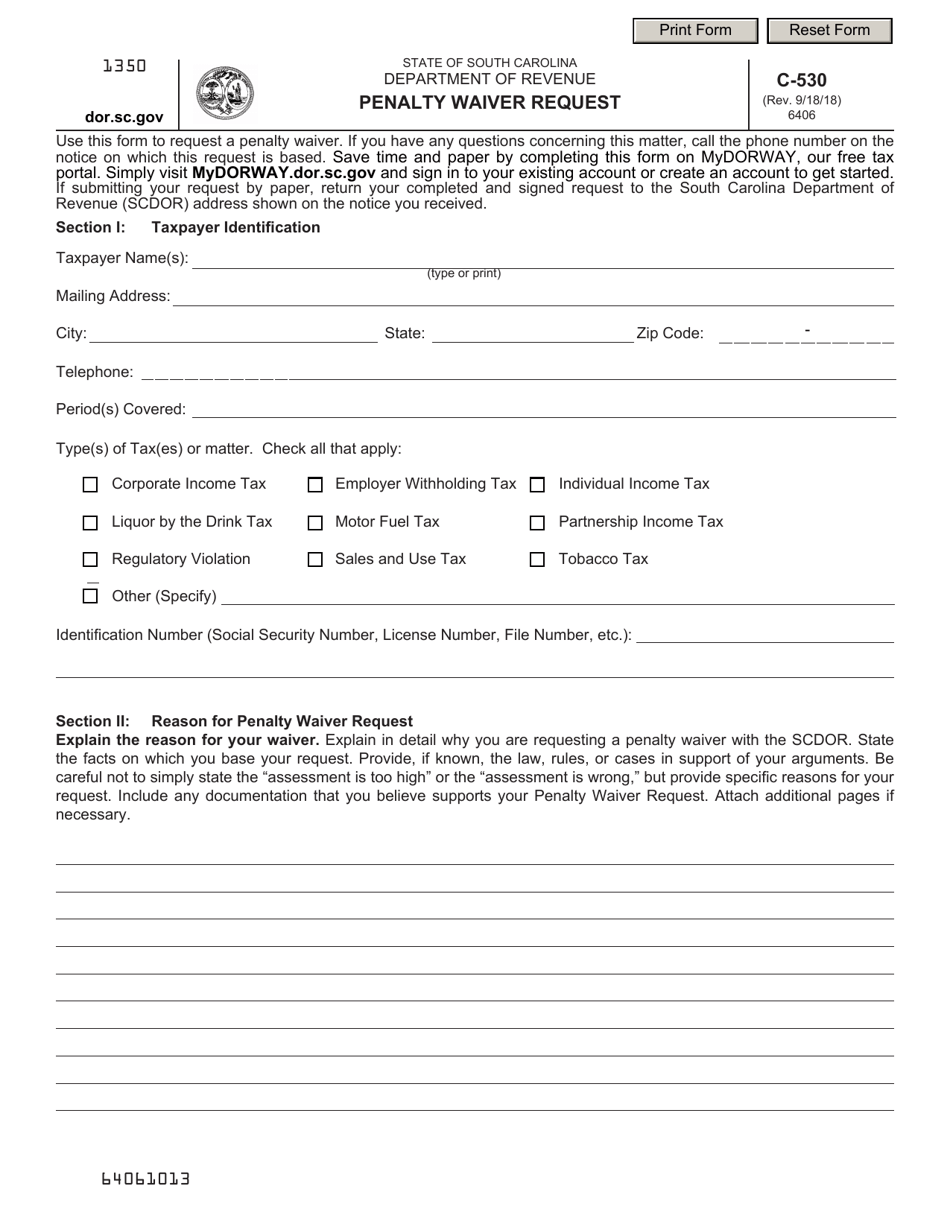

Probate Court Guidelines for Reports by Appointed Physician s Examiner s - 537PC. CASE NUMBER. Form NameRequest for Penalty Waiver.

The federal gift tax. Not all estates must file a federal estate tax return Form 706. However the federal government still collects these taxes and you must pay them if you are liable.

Filing of Disclaimer for Record - 447PC. STATE OF SOUTH CAROLINA. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state.

Also what states require an inheritance tax waiver form. Select Popular Legal Forms Packages of Any Category. Form NameSC Withholding Fourth Quarter and Annual Reconciliation Return.

Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. All groups and messages. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax.

The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. South carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. Drivers License Renewal PDF Disabled Placards and Tags.

Uninsured Motorist Registration PDF Motor Vehicle Dealership License PDF Senior Citizens Discount DOC Change of Residency Affidavit PDF Non-Profit Organizational. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does impart these taxes you will be responsible for paying them. What is a inheritance tax waiver form.

South Carolina also has no gift tax. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. Make sure to check local laws if youre inheriting something from someone who lives out of state.

Visitors Report - 531PC. ANDOR NOMINATION ANDOR WAIVER OF BOND. South Carolina Inheritance Tax and Gift Tax.

What is an inheritance tax waiver in NJ. Individual Taxes Individual Income Estate. File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View South Carolinas Top Delinquent Taxpayers.

All groups and messages. STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF RENUNCIATION OF RIGHT TO ADMINISTRATION. FORM 364ES 12016 62-3-1001e STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF _____ WAIVER OF STATUTORY FILING REQUIREMENTS IN THE MATTER OF.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. The federal estate tax is due nine months from the date of death and is currently filed when assets exceed 5450000 for decedents dying in the 2016 tax year. Form NameSC Withholding Tax Payment.

Ad Instant Download and Complete your Waiver and Release Forms Start Now. Ad Download or Email SC 364ES More Fillable Forms Register and Subscribe Now. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

There is no inheritance tax in South Carolina. South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases. Examiners Report - 538PC.

_____ Decedent I acknowledge that Personal Representatives are required by law to file the following documents prior to the closing of. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1206 million in 2022. Signature of OwnerPartnerOfficerLLC Member Print Name Date Primary Taxpayers Signature Secondary Taxpayers Signature if.

Tax and Legal Forms. Decedent By renouncing my right to serve as Personal Representative I am informing the Court that I do not want to be the Personal Representative.

Illinois Quit Claim Deed Form Quites Illinois The Deed

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Contract Template

Accident Wellness Benefit Claim Form Character Reference For Court Power Of Attorney Form Legal Forms

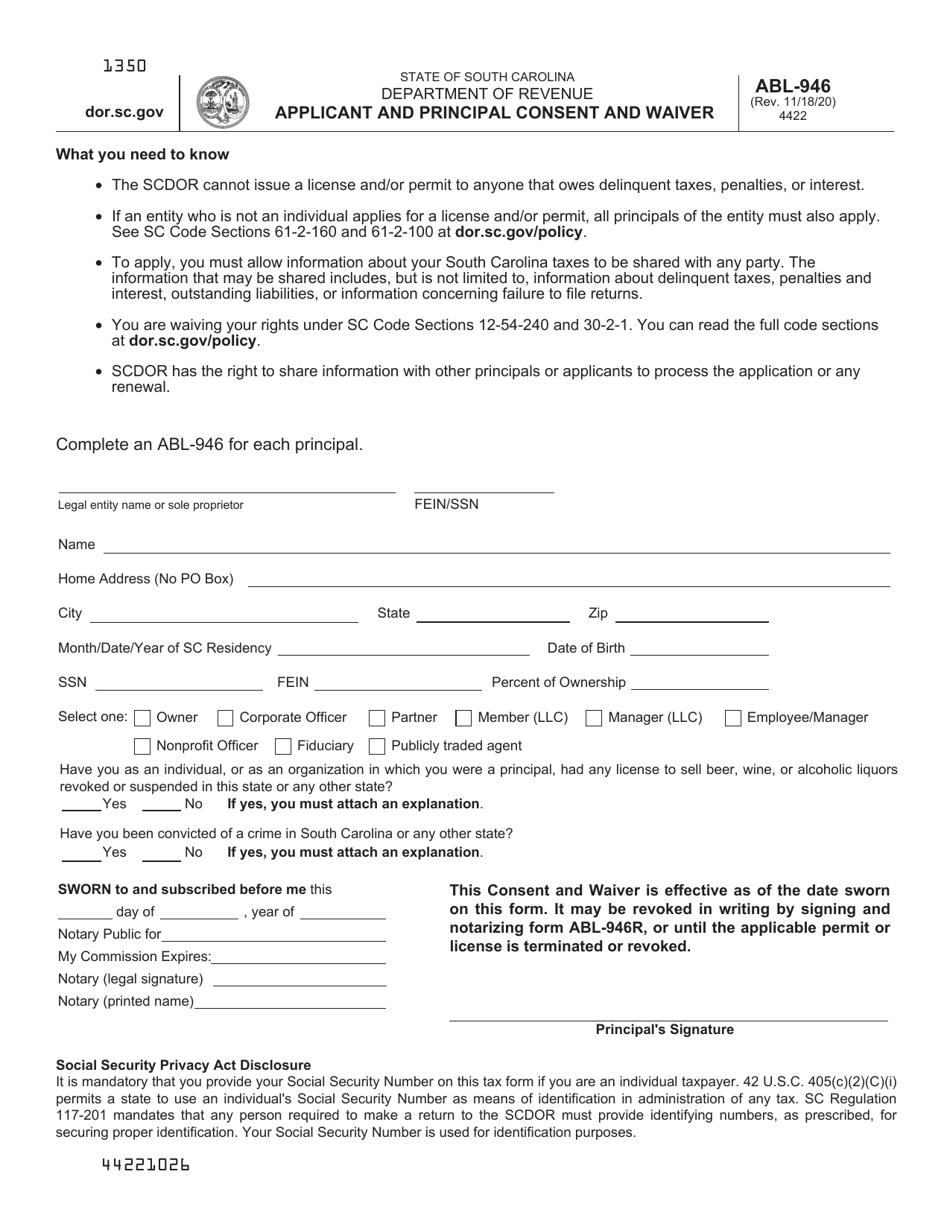

Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller

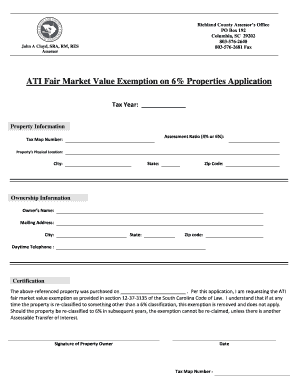

Richland County Sc Tax Assessor Fill Out And Sign Printable Pdf Template Signnow

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

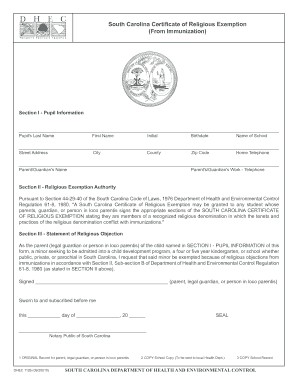

Religious Exemption Form For Covid Vaccine South Carolina Fill Out And Sign Printable Pdf Template Signnow

Free Covid 19 Liability Waiver Template Rocket Lawyer

South Carolina Assumption Of Risk Waiver And Release Of Liability Pdfsimpli

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

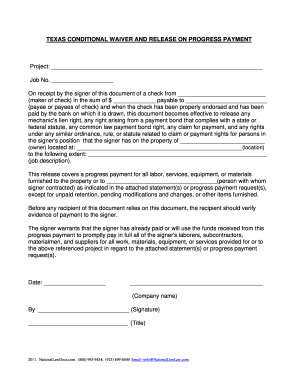

Conditional Waiver And Release On Progress Payment Form Fill Out And Sign Printable Pdf Template Signnow

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

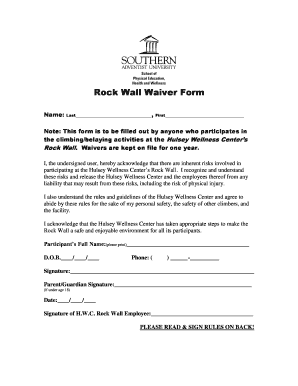

Fillable Online Www1 Southern Rock Gym Waiver Form Www1 Southern Fax Email Print Pdffiller

Fillable Online Ddsn Sc Special Needs Waiver Forms Fax Email Print Pdffiller

Free Liability Waiver Form Sample Waiver Template Pdf

Form C 530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

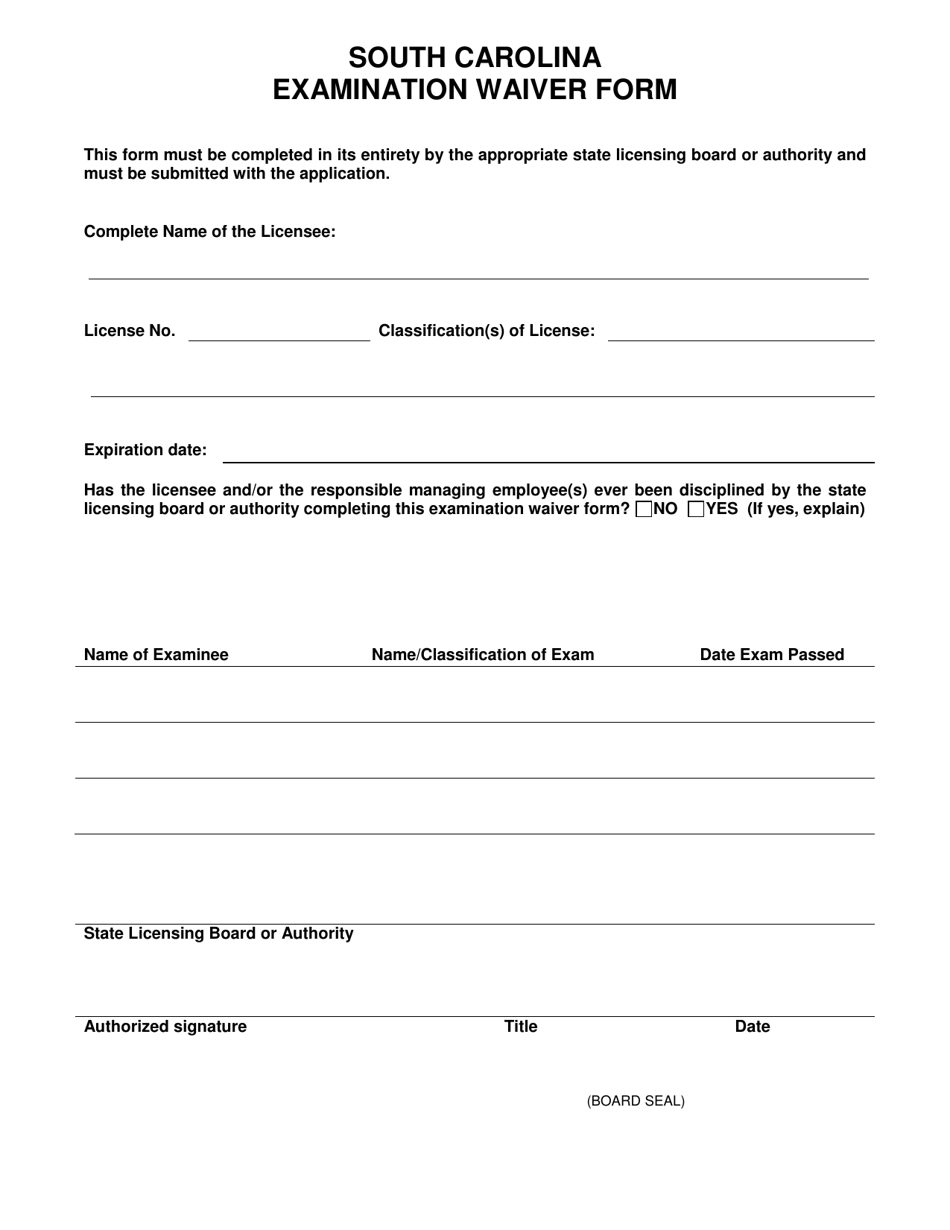

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

South Carolina Estate Tax Everything You Need To Know Smartasset